If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt.

- A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations.

- To find a business’s debt ratio, divide the total debts of the business by the total assets of the business.

- Capital-intensive businesses, such as utilities and pipelines tend to have much higher debt ratios than others like the technology sector.

- Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Subscribe to Kiplinger’s Personal Finance

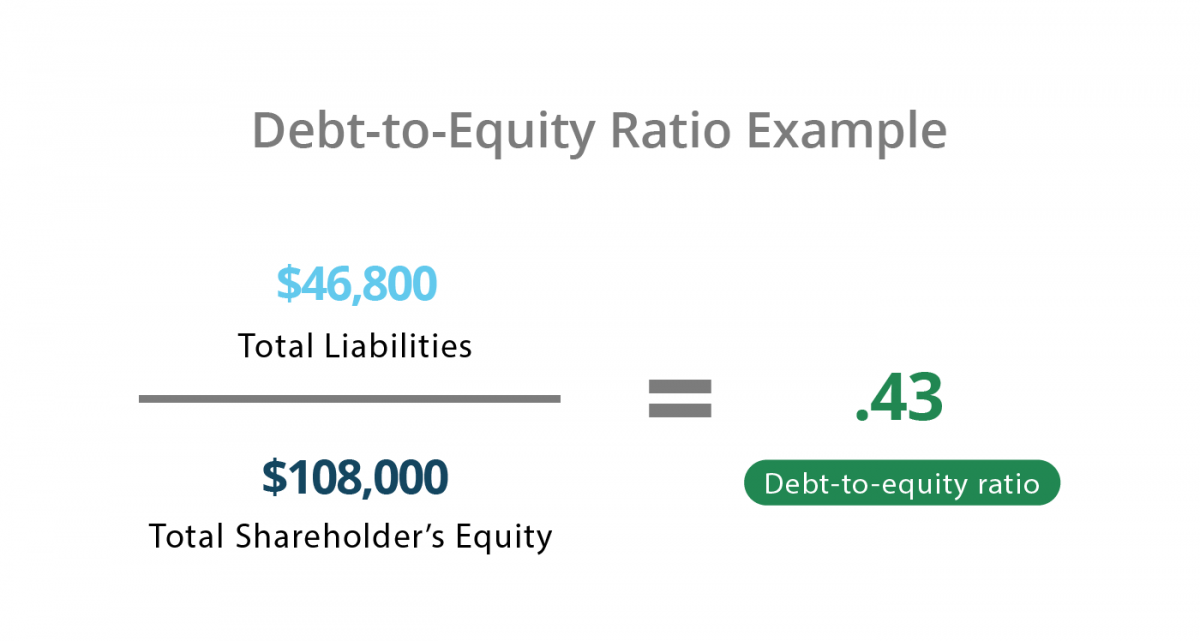

A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. In some cases, companies can manipulate assets and liabilities to produce debt-to-equity ratios that are more favorable. If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings.

Debt Ratio Example

The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations.

Debt to Equity Ratio Formula & Example

This conservative financial stance might suggest that the company possesses a strong financial foundation, has lower financial risk, and might be more resilient during economic downturns. Companies generally aim to maintain a debt-to-equity ratio between the two extremes. Obviously, it is not possible to suggest an ‘optimum’ debt-to-equity ratio that could apply to every organization. What constitutes an acceptable range of debt-to-equity ratio varies from organization to organization based on several factors as discussed below. Debt-to-equity ratio quantifies the proportion of finance attributable to debt and equity. Tax obligations, and trade & other payables have been excluded from the calculation of debt as they constitute non-interest bearing liabilities.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies. Below is an overview of the debt-to-equity ratio, including how to calculate and use it. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own financial leverage, especially when considering loans like a mortgage or car loan. From the above, we can calculate our company’s current assets as $195m and total assets as $295m in the first year of the forecast – and on the other side, $120m in total debt in the same period. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. Gearing ratios are financial ratios that indicate how a company is using its leverage. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow.

If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations.

Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture. The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations.

Financial data providers calculate it using only long-term and short-term debt (including current portions of long-term debt), excluding liabilities such as accounts payable, negative goodwill, and others. The periods and interest rates of various debts may differ, which can have a substantial effect on a company’s financial stability. In addition, the debt ratio depends on accounting information which may construe or manipulate account balances as required for external reports. In our debt-to-equity ratio (D/E) modeling exercise, we’ll forecast a hypothetical company’s balance sheet for five years. While not a regular occurrence, it is possible for a company to have a negative D/E ratio, which means the company’s shareholders’ equity balance has turned negative.

Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt. However, study on operational readiness growth and profitability if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. It is a problematic measure of leverage, because an increase in non-financial liabilities reduces this ratio.[3] Nevertheless, it is in common use.