Other companies that might have higher ratios include those that face little competition and have strong market positions, and regulated companies, like utilities, that investors consider relatively low risk. However, the acceptable rate can vary by industry, and may depend on the overall economy. A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). However, it is crucial to compare the D/E ratio with peers in the same industry and consider the company’s specific circumstances for a more insightful analysis.

The D/E Ratio for Personal Finances

In other words, the ratio alone is not enough to assess the entire risk profile. Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). Below is an overview of the debt-to-equity ratio, including how to calculate how to prepare a master budget for your business in 2021 and use it. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity.

Examples of D/E Ratio calculations for different companies

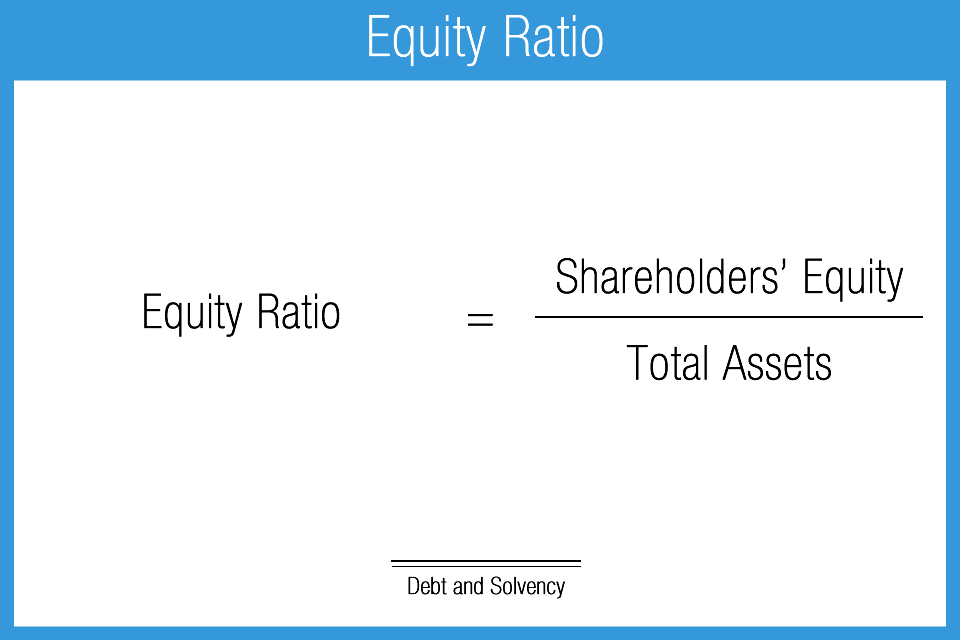

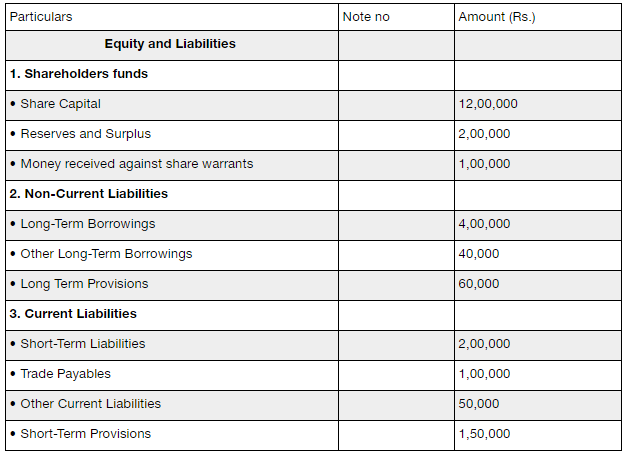

In the next sections, we will explore real-life applications of the ratio through case studies, providing practical examples of how this metric can be used in financial analysis. Shareholders’ Equity is the amount of money that would be returned to shareholders if all the assets were liquidated and all the company’s debt was paid off. It reflects the company’s net worth and is a critical component in various financial metrics, including the D/E Ratio.

The Debt/Equity Ratio: A Comprehensive Analysis

As a result, there’s little chance the company will be displaced by a competitor. The investor has not accounted for the fact that the utility company receives a consistent and durable stream of income, so is likely able to afford its debt. When assessing D/E, it’s also important to understand the factors affecting the company. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor. As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context.

Q. Can I use the debt to equity ratio for personal finance analysis?

Finally, the debt-to-equity ratio does not take into account when a debt is due. A debt due in the near term could have an outsized effect on the debt-to-equity ratio. So in the case of deciding whether to invest in IPO stock, it’s important for investors to consider debt when deciding whether they want to buy IPO stock. Today, I juggle improving Wisesheets and tending to my stock portfolio, which I like to think of as a garden of assets and dividends. My journey from a finance-loving teenager to a tech entrepreneur has been a thrilling ride, full of surprises and lessons. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- Including preferred stock as debt can inflate the D/E ratio, making a company appear riskier, whereas counting it as equity would lower the ratio, potentially misrepresenting the company’s financial leverage.

- The D/E Ratio is also crucial for comparing companies within the same industry.

- Let’s examine a hypothetical company’s balance sheet to illustrate this calculation.

- Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio.

- Inflation can erode the real value of debt, potentially making a company appear less leveraged than it actually is.

If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials. If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection.

A lower debt-to-equity ratio means that investors (stockholders) fund more of the company’s assets than creditors (e.g., bank loans) do. It is usually preferred by prospective investors because a low D/E ratio usually indicates a financially stable, well-performing business. This debt to equity calculator helps you to calculate the debt-to-equity ratio, otherwise known as the D/E ratio.

At its simplest, the debt-to-equity ratio is a quick way to assess a company’s total liabilities vs. total shareholder equity, to gauge the company’s reliance on debt. For instance, a high debt-to-equity ratio may not be a concern if the company has a strong interest coverage ratio, indicating it can easily meet its interest payments. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good.